How Klarna Works

Klarna is the smooothest & safest way to get what you want today, and pay over time.

How To Use:

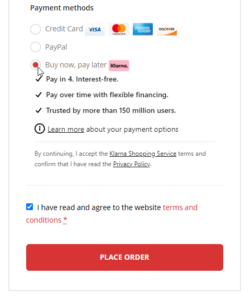

Select “Buy now, pay later (Klarna)” during checkout. Then click on “Place Order” to proceed to Klarna’s website to finish the order process.

Pay in 4.

Divide your purchase price into four installments, each to be paid bi-weekly. This provides you with more time to settle the cost for the items you adore.

Pay in 30 days.

Begin relishing your order immediately. Make your payments online after experiencing the product in real life. Pay solely for what you decide to retain.

Monthly financing.

In collaboration with WebBank, a member of FDIC, Klarna provides clear and straightforward credit options that offer you the flexibility needed to effortlessly make larger purchases.

Inquiries related to your credit rating.

When you utilize Klarna to divide your purchase into four payments without interest, Klarna conducts a soft credit inquiry. This will not impact your credit rating; it merely assists Klarna in verifying your timely bill payments.

There exist two types of credit checks—hard and soft. Klarna performs a soft credit check for the Pay in 4 option, which does not affect your credit score as it isn’t reported to the credit bureaus.

Should you be interested in Klarna’s financing options, a hard credit check may be necessary. This is reported to the credit bureaus and will appear as an inquiry on your credit report. Monthly financing through a Klarna credit account is facilitated by WebBank, a member of the FDIC.